We’ve been talking a lot about acceptance recently. Accepting the current situation. Accepting the pandemic. Adopting a “coping mindset.” This mentality makes us more proactive, not reactive, especially when it comes to our finances.

With the “new normal” likely to be with us for some time, we need a new approach to our finances. We should accept that things are different now, and that’s OK. It will get better soon. Here are 6 COVID-19 budgeting tips for motion picture industry veterans.

#1. Create an Emergency Budget

Times are tough, so pare down and reign in your spending. Every little bit helps. Creating an emergency budget (with income and expenditure) prioritizes the “essentials” — bills, food, gas, etc. Yes, this means cutting out unnecessary spending, but it’s just for a little while. Go on that Hawaii vacation next year.

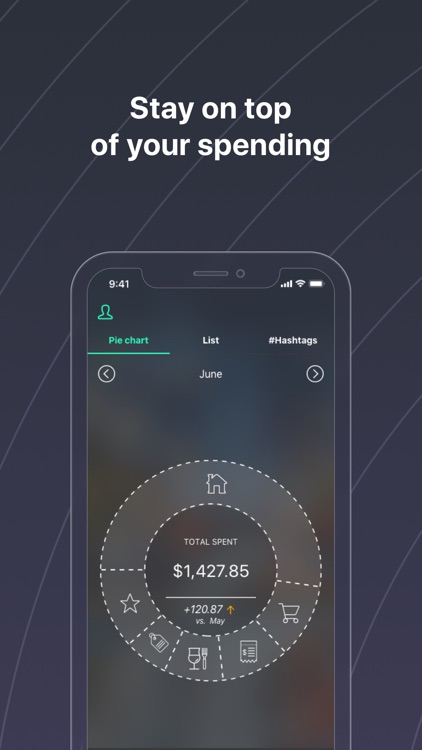

#2. Use Budgeting Apps

Not all of us are good at math. Thankfully, there are budgeting apps that track expenses and manage debt. Mint and PocketGuard do the job well, but there are others. Check out the App Store or Google Play.

There are also several options for tracking your budget in a simple spreadsheet. Check out tiller or aspire for easy-to-use templates.

#3. Prioritize Your Bills

Not all bills are deemed equal. Not right now. The most important? Probably, rent/mortgage payments and groceries. Pay these first.

Ask lenders to pause payments for a month (or two) until you get back on your feet. It depends on the lender, but many companies have been flexible during the pandemic. At the very least, negotiate minimum credit card repayments.

Tempted to cash out your 401(k)? Think carefully about the future. This pandemic has taught us that anything’s possible…

#4. Pause Your Subscriptions

Canceling your cable provider or favorite streaming service might seem like a sin. We’re all in the entertainment industry, and we want our creators (and everyone else in front of/behind the camera) to thrive. But if you can’t afford it, pause (not cancel) your subscriptions for a couple of months until your finances improve.

#5. Don’t Apply for More Credit (If You Can)

It might be tempting to get finance now. The future is uncertain. You need a safety net. But (try to) hold out for a little longer. A shiny new credit card is certainly enticing, but you could rack up additional debt if you spend on it.

#6. Still Struggling? Get Help

Here at the Will Rogers Motion Picture Pioneers Foundation, we have a wide range of financial assistance programs for people in the motion picture entertainment industry, including our COVID-19 emergency grant. If you’re struggling, give us a call or send us a message.